Policy Update and Register Now for Legislative Launch

November 14, 2025 | Public Policy

State Policy Update

State Budget Outlook

The Revenue Estimating Conference (REC) met on October 16 and projected a 9% decline in state revenues for FY 2026, primarily due to ongoing state tax cuts and reduced agricultural exports. Sales tax revenues are expected to rise slightly (about 2.5%), while individual and corporate income tax collections are projected to fall by more than 10%.

Although state revenues are declining, officials indicated Iowa’s economy remains stable and continues to grow moderately. The state holds roughly $6 billion in reserves to balance the FY 2026 budget and offset projected shortfalls. The REC will meet again in December to finalize revenue estimates used by lawmakers to set next year’s spending levels.

Understanding these trends helps the Economic Alliance anticipate potential impacts on investments that support business growth, workforce development, infrastructure, and tax structures.

State DOGE Report – Efficiency and Alignment in State Government

Governor Reynolds announced findings from the Department of Government Efficiency (DOGE) Task Force, which evaluated how Iowa could streamline operations and improve public services. Key recommendations include:

- Combining tax credits and workforce training programs to reduce overlap and improve outcomes.

- Expanding use of AI for state data systems and fraud detection.

- Benchmarking public-sector benefits and pay against the private sector.

- Exploring a voluntary defined contribution retirement option.

- Allowing shared services between local governments to reduce costs.

- Creating efficiency grants and allowing larger cities to assume some county-level services.

It is unclear at this time if the legislature will pursue any of these recommendations during the 2026 session. The Economic Alliance will continue to track these proposals closely because changes in workforce training, local government operations, and state tax structures can influence the cost of doing business and the efficiency of public services that support employers.

Property Tax Reform Conversations Continue

Property tax reform is expected to be a priority issue again in the 2026 legislative session. In recent weeks, the Governor and Republican leaders have held roundtables across the state seeking input. Discussions have included changes to the rollback formula, limits on local government spending, and reforms to Tax Increment Financing (TIF). The Economic Alliance will continue advocating for balanced reforms that support community investment while maintaining Iowa’s competitive business environment.

Federal Policy Update

Economic Alliance Joined National Call to End Federal Shutdown

In the last several weeks, the Economic Alliance joined Chambers across the country, led by the U.S. Chamber, to urge Congress to approve legislation reopening the federal government. The government has since reopened after President Trump signed a funding bill into law on November 13. Each day the government remained closed, the risks to the nation’s economic and national security grew. The shutdown, the longest in US History, harmed small businesses, disrupted the economy, and jeopardized essential services relied upon by millions of Americans.

Supporting Trade is Essential to our Economic Success

The Economic Alliance signed a U.S. Chamber-led coalition letter to Ambassador Jamieson Greer, U.S. Trade Representative, emphasizing continued support for the U.S.–Mexico–Canada Agreement (USMCA). For Iowa businesses, maintaining USMCA stability protects critical export markets and strengthens global competitiveness. The agreement ensures that U.S. manufacturers, farmers, and service providers retain access to Canada and Mexico, Iowa’s top two export markets. It secures tariff-free trade for most U.S. exports and supports more than 13 million American jobs.

Business Resources

Employer Toolkit: Immigration Enforcements A new employer toolkit offers guidance on immigration compliance and workforce strategies, helping businesses navigate evolving employment rules.

Talent Workforce Coalition FAQ A new federal law now allows education savings accounts, once limited to college expenses, to also cover career credentialing and certification programs. This change helps workers invest in new skills and supports employers focused on talent development.

Register here for upcoming Public Policy events!

2026 Legislative Launch – Register Now!

Join us for our annual Legislative Launch, when we reveal our 2026 legislative priorities and members connect directly with state legislators ahead of the 2026 session. This event provides an opportunity to share business perspectives on issues such as workforce, taxation, and infrastructure. Your voice helps ensure policy decisions reflect the needs of our region’s employers and economy. Register here.

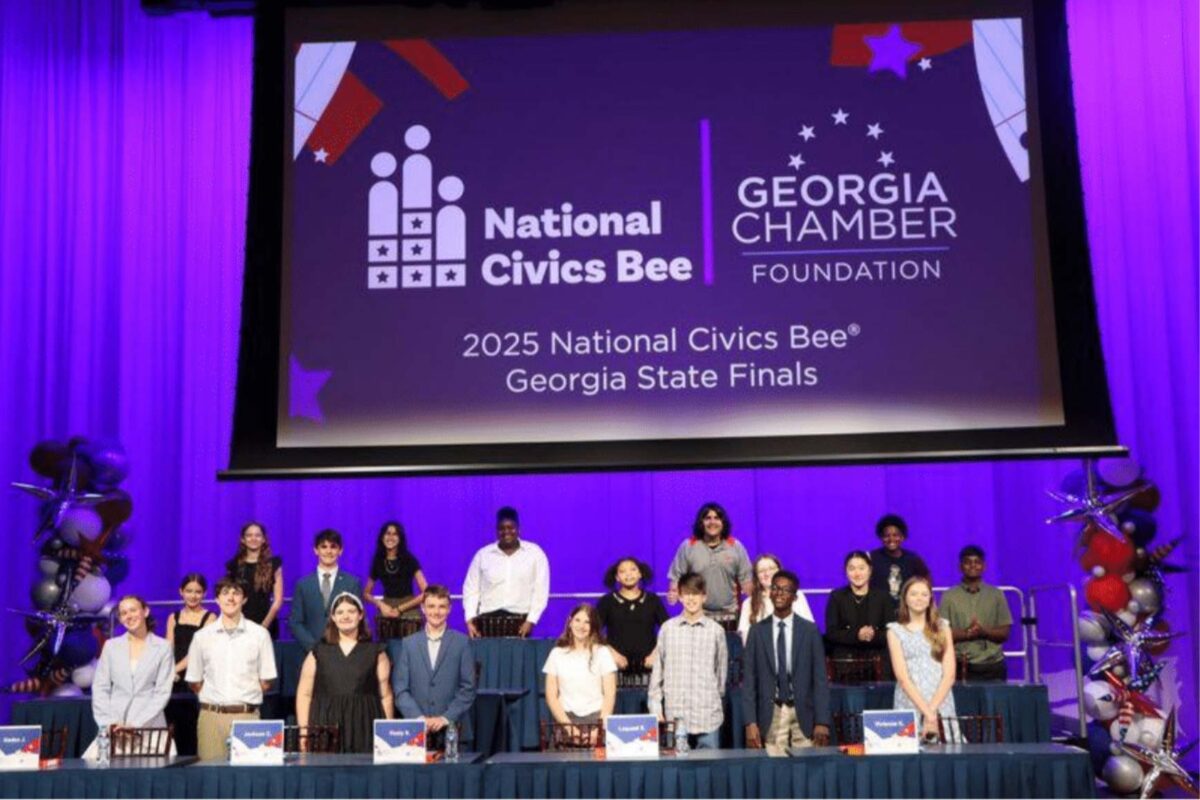

Regional Civics Bee Competition in 2026

The Economic Alliance will host a Regional Civics Bee this spring as part of a nationwide effort celebrating America’s 250th anniversary. Middle school students will showcase their civics knowledge and ideas for improving their communities. Please encourage all Middle School students throughout Eastern Iowa to participate! By supporting this initiative, the Economic Alliance is helping to cultivate future community leaders and strengthen the foundation of civic engagement that underpins a healthy business climate. Learn more here.